- Case Studies

-

Services

Services

-

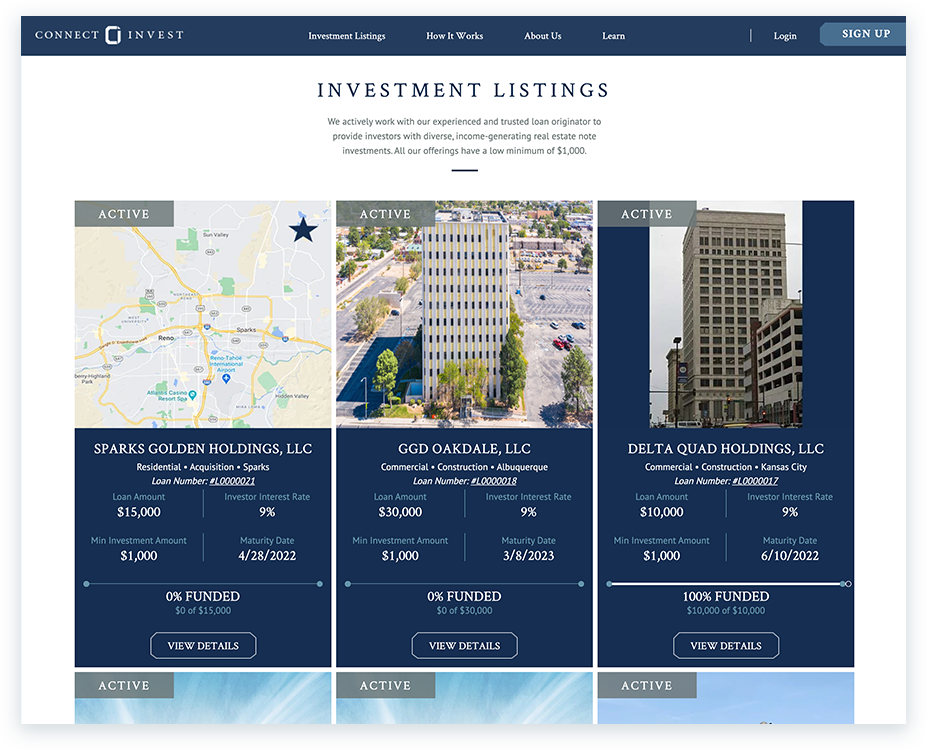

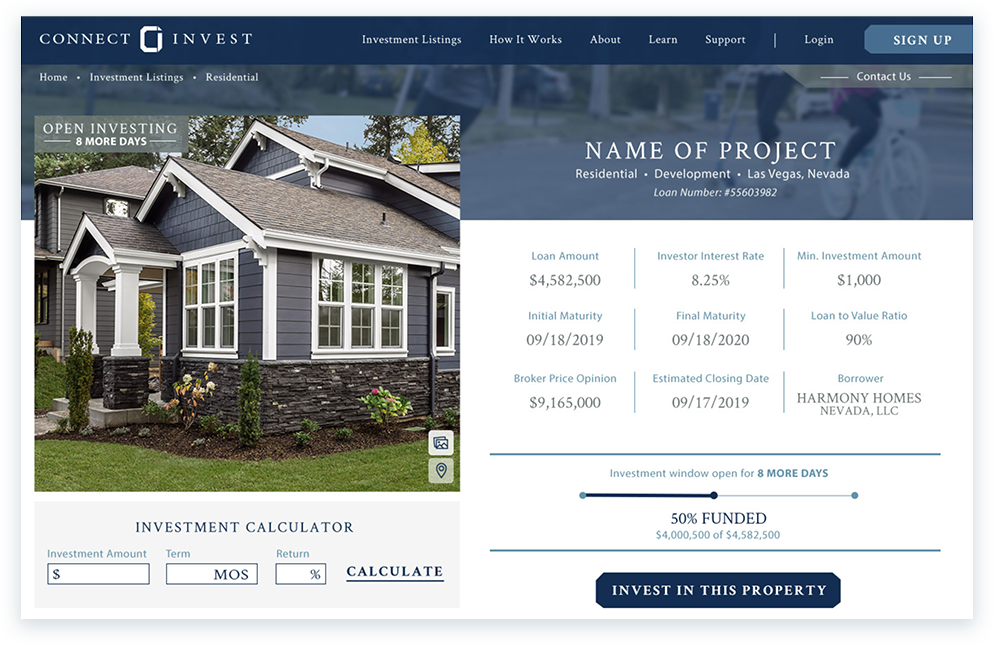

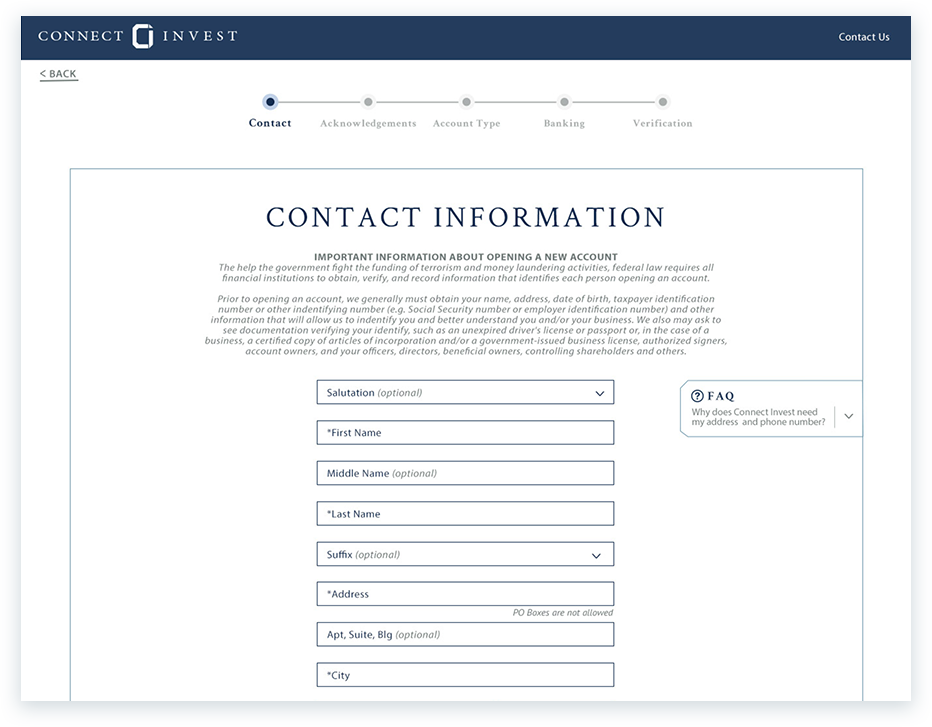

Web Development

Combine Guidance's technical depth and world class CX for intuitive digital experiences.

-

Customer Experience

Proven conversion rate optimization (CRO) strategies and award winning creative to elevate your brand storytelling.

-

B2C Ecommerce

Optimize the path to purchase and boost conversion for long term success.

-

B2B Ecommerce

Transform channel cannibalization into new market penetration and profitability.

-

Web Development

-

Platforms

Platforms

-

Adobe Commerce (Magento)

User-friendly interface, drag-and-drop capabilities, and in-line editing to create experiences that integrate seamlessly on mobile, social, or in-store

-

Optimizely (Episerver)

Fully integrated and specifically designed for modern ecommerce, content, merchandising and marketing

-

BigCommerce

Sell more at every stage of growth, from small startups, to mid-market businesses, to large enterprises with the leading Open SaaS solution

-

Shopify Plus

Launch quickly with the omnichannel enterprise platform where you can start, grow, and scale your business—backed by an ethical pricing model.

-

- About Us

- Blog

- CONTACT US