With just under two months until Tax Day in the United States, it’s high time that we review some of the big changes happening in the tax compliance space with help from our partners at Avalara.

While we understand every business’s taxes are unique to their city, state, and country; we want to go over some changes and predictions that may impact the way you think about tax in 2024.

AI & Tax Automation in 2024

“In 2024, AI’s integration with data and knowledge will become increasingly common. Expect to witness a surge in AI assistants within compliance sectors, performing tasks such as data analysis, deduction identification, anomaly detection, and aiding in tax research and filing,” according to Vsu Subramanian - SVP of Content Engineering at Avalara

2024 will be a pivotal moment in AI’s development, with governments’ initiation of guidelines and regulations to oversee its implementation. AI scans will be like security scans, verifying information accuracy. This will make AI more accessible, creating new jobs like prompt engineering. Also, easy-to-use tools will allow non-technical people to do different tasks in business, like making iPhone apps without coding.

2024 will be a pivotal moment in AI’s development, with governments’ initiation of guidelines and regulations to oversee its implementation. AI scans will be like security scans, verifying information accuracy. This will make AI more accessible, creating new jobs like prompt engineering. Also, easy-to-use tools will allow non-technical people to do different tasks in business, like making iPhone apps without coding.

Social Commerce Grows Retail

George Trantas, Sr. Director of Global Marketplaces states ““In 2024, we’ll see marketplaces continue to shift how they think about getting products in front of consumers.”

But Scott Peterson, Avalara’s VP of US Tax Policy warns that marketplaces may have new changes and regulations coming in 2024. “We’re also expecting new changes with rules and regulations for marketplaces. In the wake of the 2018 Wayfair decision, states didn’t realize just how broad marketplaces would get and the variety of buckets they would fall into. Even conflicts over areas like communications excise taxes are leading states to ask questions around what is and isn’t taxable. In 2024, we’ll start to see more and more marketplace regulations as new marketplaces emerge and goods and services that are sold on and through marketplaces continue to expand.”

As we noted in our NRF Big Show blog post, Omnichannel (or Unified) commerce will need to become seamless across platforms.

The rise of social media and online shopping is closely connected to omnichannel strategies, blending online and in-store shopping. This meets the convenience needs of customers and helps stores reach more people, even on new online markets. It's crucial for businesses to make sure shopping is easy across different platforms.

Many retailers won’t even need to run ads because they can sell directly to consumers through social media. “As social media platforms evolve into vital retail spaces, advanced features like product tagging by influencers are reshaping how products can be advertised and sold,” Trantas adds.

E-Invoice Will Grow in the US

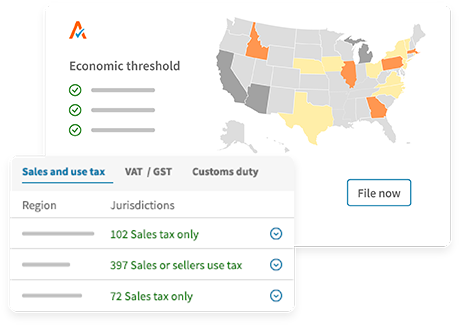

Over the past 6 months, Avalara has turned their focus to the growth of e-invoicing as they anticipate a large change in the market with tax compliance and business processes will converge together into a single process with e-invoicing.

“We’ll also see e-invoicing make its way to the United States. The federal e-invoicing pilot was the first major step to a more broad e-invoicing regime in the U.S., and in 2024, we’ll see that momentum continue. There’s even potential for the creation of a new way for states to create one record format. States are going to start using the e-invoicing pilot, which will reduce the time that states will spend on audits, so they’ll be able to conduct more audits.” says Alex Baulf, Avalara’s VP of E-Invoicing.

In the U.S., e-invoicing won't primarily be pushed by the government but by businesses themselves. This shift will bring quicker, more precise, and dependable payments. In 2024, we anticipate more service providers and businesses embracing e-invoicing.

—

As an Avalara Certified Implementer, Guidance is focused on all of the tax changes that will impact ecommerce brands throughout 2024 and the future. We have worked with dozens of brands on their AvaTax, Managed Returns, and ECM Pro integrations over the past five years.

Want to learn more about how Guidance is helping brands take the stress out of their taxes and allow more time to focus on growing their business? Click the Contact button below to chat with our team.